The Sejm passed an amendment to the VAT law on Friday, April 12, 2019. The amendment stipulates that:

- a database (List) of VAT taxpayers will be created and made available on the Ministry of Finance's public, free website. Access is also to be possible from CEiDG. The list is to be updated once a day;

- Each VAT taxpayer is required to provide (as part of the update notification) the numbers of his settlement accounts related to his business to the Tax Office (US) in order to make them available within the aforementioned List. The account numbers will be confirmed using the STIR ICT system;

- the taxpayer will not be able to recognize as a deductible expense the payment for a VAT invoice (FV) for an amount of more than PLN 15,000, which went to an account of the taxpayer (issuer of the invoice) other than the one indicated in the List. Another sanction may be joint and several liability for the amount of VAT from the aforementioned FV in a situation where the issuer of the FV (recipient of the transfer) has not paid such tax;

- Liability is to be excluded in the event of: (1) notification to the Head of the Tax Administration having jurisdiction over the issuer of the invoice within 3 days of submission of the transfer of payment to an account number other than the one indicated in the Schedule, (2) payment in the form of Split Payment;

- The banking sector is studying the possibility of developing a tool to verify whether an account has been included in the List already at the stage of transfer. Effective implementation of such a solution would greatly simplify verification.

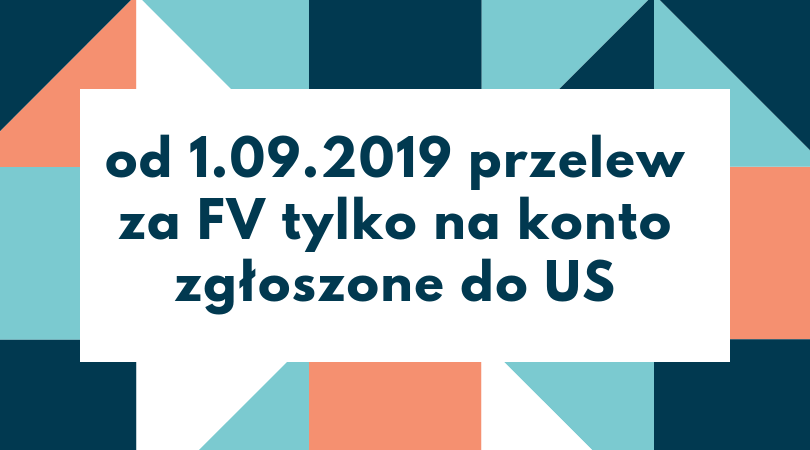

- The draft, as currently drafted, is scheduled to go into effect on 1.09.2019 r., with the exception of the sanctioning provisions, which are to take effect from 1.01.2020. Time is short - especially since Banks and companies have to adjust their accounting and billing systems, and the List is expected to be created by....31.08.2019. The premise of the project is to minimize the risk of taxpayers unwittingly participating in VAT carousels and to seal the VAT system.

Legislative process was brief. The topic of factoring came up in the consultations, with comments mainly from the Polish Bank Association. In the consultations, many entities drew attention to problems related to the lack of reporting of accounts other than clearing accounts to the list (e.g., custodial, technical), as well as the massiveness of technical accounts, and the speed collect service and the associated risks of depriving the payer of the right to deduct the TAX.

The amendment adopted by the Parliament, assuming its final enactment, will undoubtedly will affect the factoring industry As well as handling factoring transactions and entering into new agreements. After reviewing the legislative process, I still have huge doubts about the actual content of the regulation and its effects on the factoring industry. Evaluating the regulation 'in the heat of the moment' - in my opinion we can expect the following its effects on factoring:

- Need to update and report all assignment accounts to the US. In the case of factoring companies, this problem is not insignificant due to the use of assignment accounts. Given the above, in order not to risk a situation in which the factoring recipient (counterparty) will verify the bank account number from the FV covered by the global assignment and not make payment due to the non-existence of the account in the List - in the case of assignment accounts maintained for: (i) the factor as holder - each factor will be forced to direct immediate update notifications to the US upon the establishment of a new assignment account; (ii) the factor as holder (an account secured only by a power of attorney granted to the factor) - each factor will be forced to direct immediate update notifications to the US upon the establishment of a new account;

- I have my doubts about how the legislature ultimately solved the problem technical accounts (not included in the List). The (main) account is reported to the US, and virtual accounts (bank account numbers) are linked to this account. The US does not report the numbers of the "virtual" accounts linked to this account (where each customer has its own account number), so the recipient paying the invoice will not therefore link this "own" virtual account to the accounts in the List. For banks using them for factoring as well, this problem is significant.

- For factoring companies, the number of reported accounts can go into the tens / hundreds / thousands.

- Verification of account with FV by the factoring recipient (counterparty) can therefore be an onerous activity. Seeing these inconveniences and not wanting to take on additional responsibilities, some recipients may switch to payment under the Split Payment;

- Factoring clauses will have to be even clearer and tailored to the type of assignment account, unambiguously identifying the Factor as the creditor from the FV, but also directly indicating to whom the bank account indicated on the FV belongs. This is because there can be no situation in which the factoring counterparty (recipient) fails to verify in the List the account from the FV assigning it to the Factor instead of the Factor, or vice versa;

- Undoubtedly, the existing designs will also change notices of assignment;

- The situation is complicated for silent factoring and depends on whether the account reported on the FV is that of the factor, factor, or escrow. In the case of the factor's account, the problem will not arise (the factor should only report the account). In the case of specifying on the FV an assignment account maintained by the bank for the factor, then the counterparty (recipient) will not be able to verify the account number in the Inventory, because it will not be assigned to the factor, but to the factor. He may also realize that there has been a silent assignment. In such a situation, the counterparty (recipient) may refuse to make the payment or execute it under the Split Payment mechanism. At this stage, it is difficult to clearly assess the effects of the regulation on escrow accounts used in silent factoring. In principle, escrow accounts are not covered by the regulation, as the new regulations only apply to "settlement accounts within the meaning of Article 49, paragraph 1, item 1 of the Act of August 29, 1997. - Banking Law" or named accounts in SKOK, and therefore should not apply to trust / escrow accounts. The above means that without knowing that the account constitutes an escrow, recipients may try to verify the account to no avail and have doubts about the payment, which in the worst case may end up in making a split payment transfer, which, as we know with an escrow account, will not be credited, but reversed.

The justification of the amendment touches on factoring, but the content of the justification in view of the content of the law can hardly be considered readable and understandable. Below is an excerpt from the content of the justification:

"A separate regulation has been introduced for a transfer order related to so-called factoring and similar agreements. Under this type of agreement, transfer order rights related to invoices issued by the supplier of goods or services are transferred to another entity (e.g., a factor) that is a creditor of another legal relationship. The need for such a regulation arises from the fact that in such a situation the transfer order is made to the account of an entity other than the supplier of the service or goods, which should not cause negative consequences for the debtor, as long as the transfer is made to the account of that other entity, which is listed.

A situation in which a third party (e.g., in connection with a factoring, assignment of receivables, transfer or similar agreement) would make a payment to a supplier (service provider) to an account that is not listed has been specifically regulated. Leaving this situation unspecified would offer the possibility of circumventing the introduced regulations. In order to prevent this, provisions have been added to Article 14 of the PIT Law and Article 12 of the CIT Law, which mandate the recognition of income for the factor to the extent that the payment related to the transaction referred to in Article 19 of the Business Law was made to an account other than the one on the list."

Details in parliamentary prints 3301 and 3360.

Let's hope that the final content of the amendment (after possible amendments by the Senate) will be further clarified.

I encourage you to discuss the potential effects of the amendment on factoring.